Check Out Our Resources

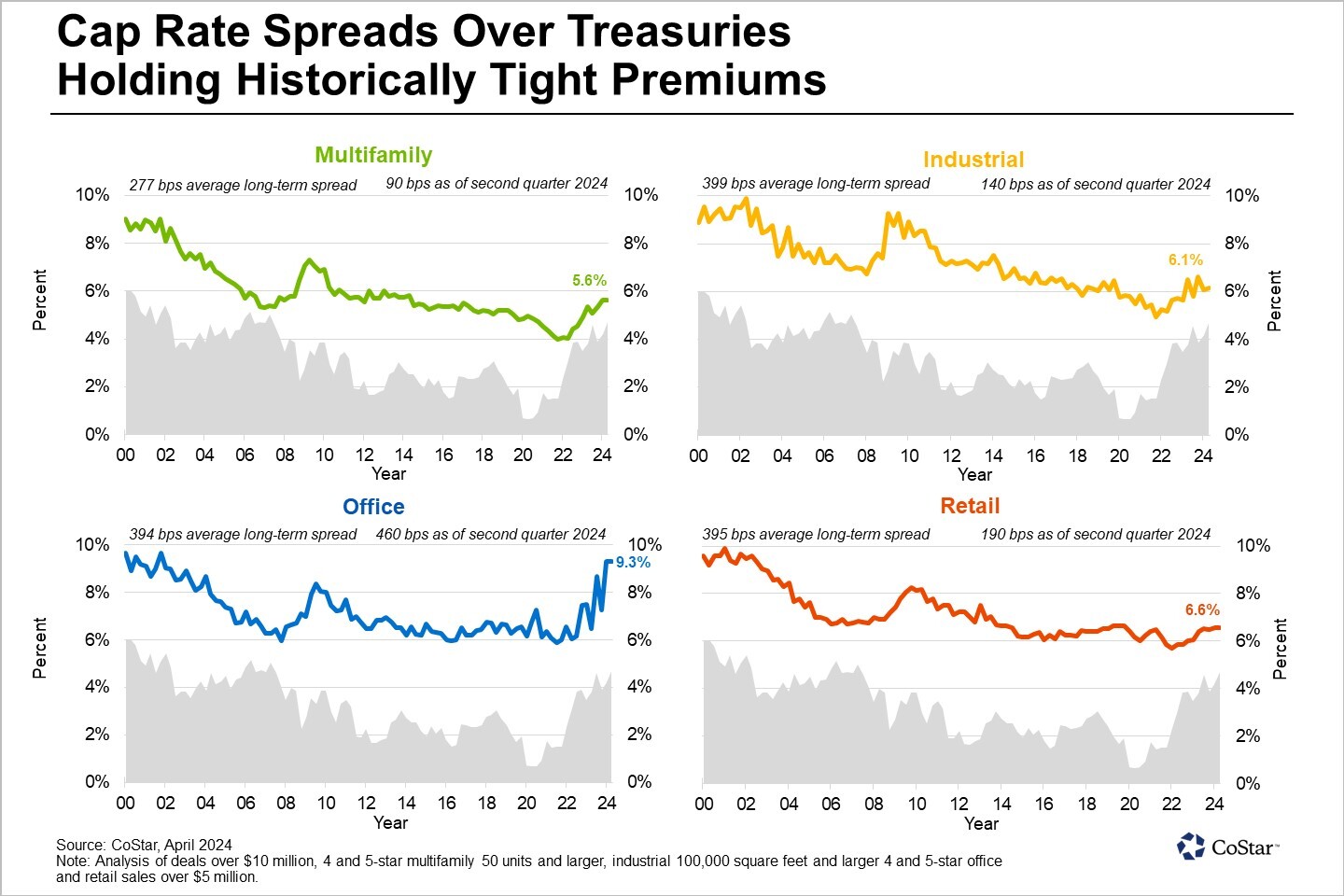

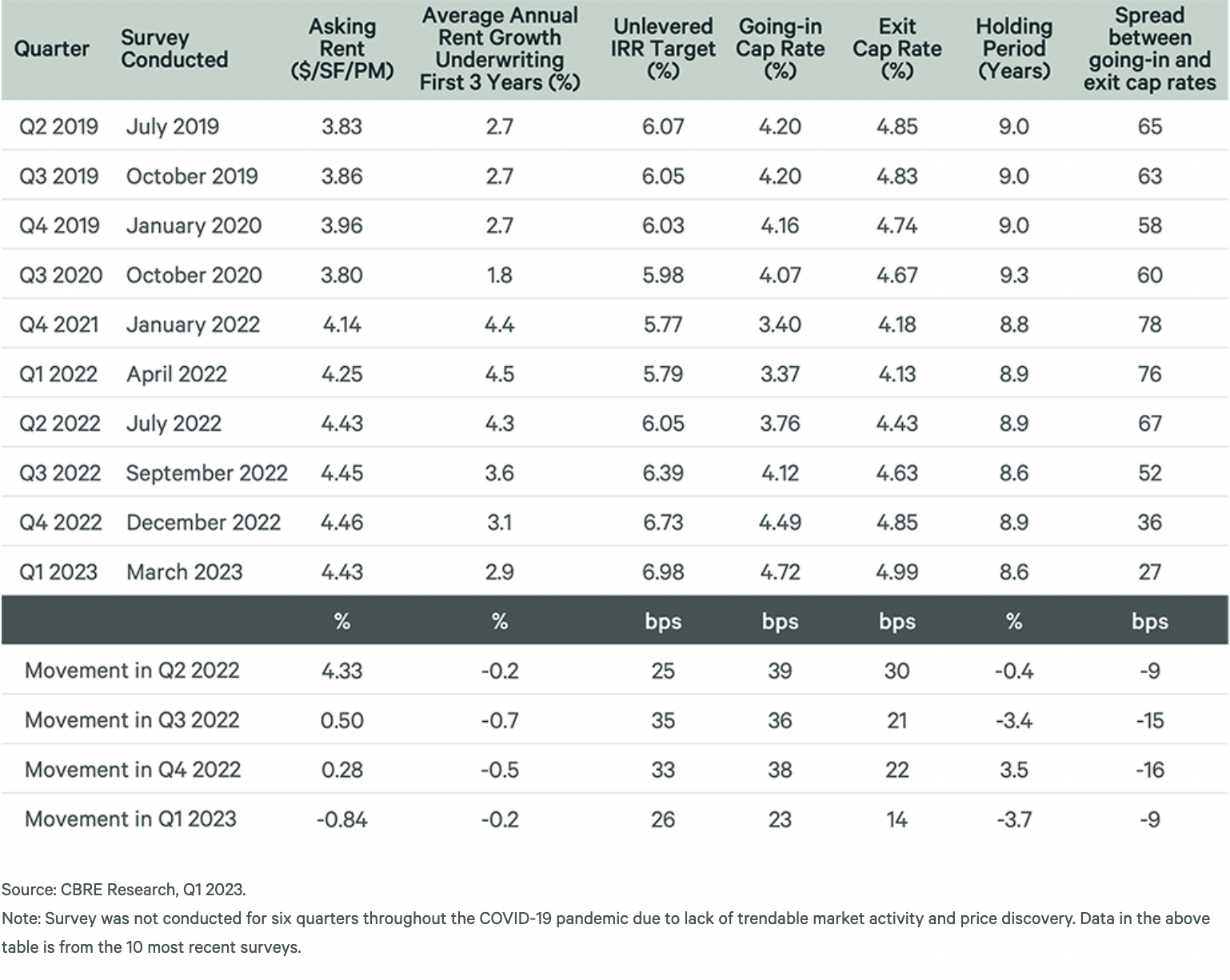

Expanding capitalization rates for property sales across the primary commercial real estate sectors shed light on evolving investor sentiment, especially as interest rates remain elevated and expectations adjust regarding property income growth.

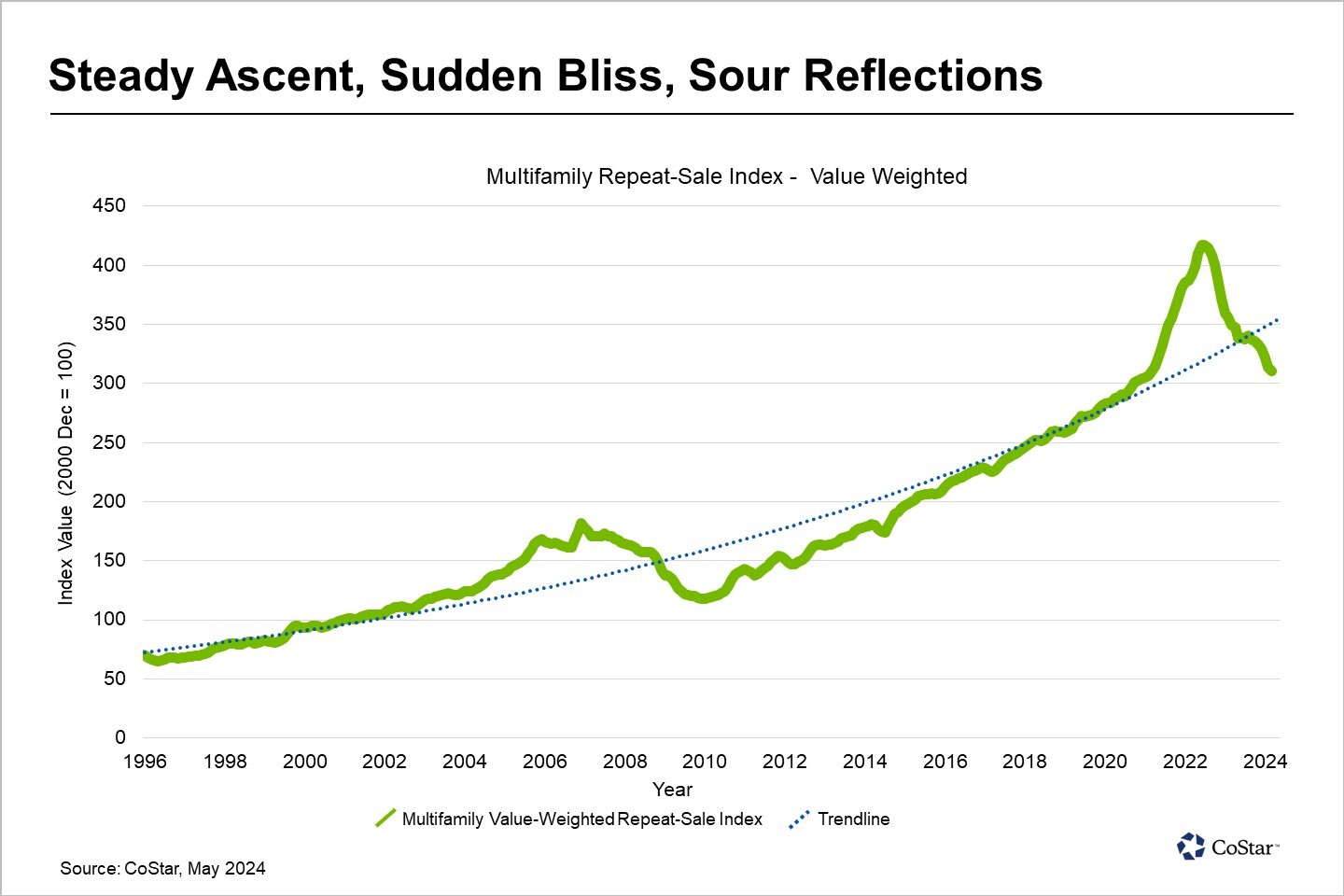

Commercial real estate pricing cycles have recently run in periods of seven to 10 years and are usually accented by brief and hard-hitting bouts of volatility.

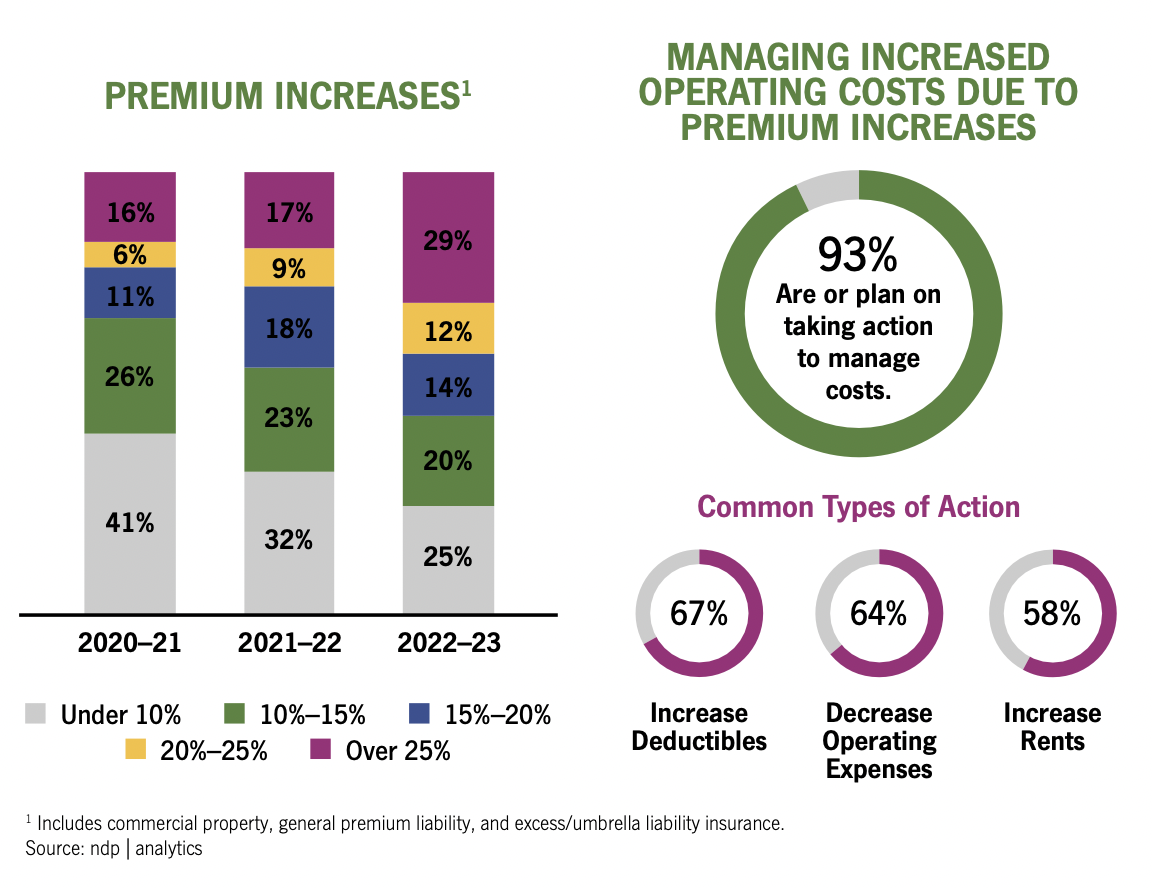

Property insurance costs continue to climb, rising an average of 27.7% per unit year over year, according to Yardi Matrix data.

When Terri Clifton began sifting through insurance policy renewal offers for Better World Properties (https://www.bisnow.com/tags/better-world-properties)’ multifamily assets last month, she felt a moment of relief that this year's double-digit increases came in far lower than last year's 100% rate hike.

After spending the last 18 months shrouded in uncertainty, many real estate professionals in North Texas were reluctant to predict how the market would perform in the new year.

Over 93% of housing providers said they are taking action to mitigate increased insurance costs, according to a new report by the National Leased Housing Association (NLHA).

Just in time for the holidays, renters are being gifted more perks when leasing apartments in a market that is delivering more supply.

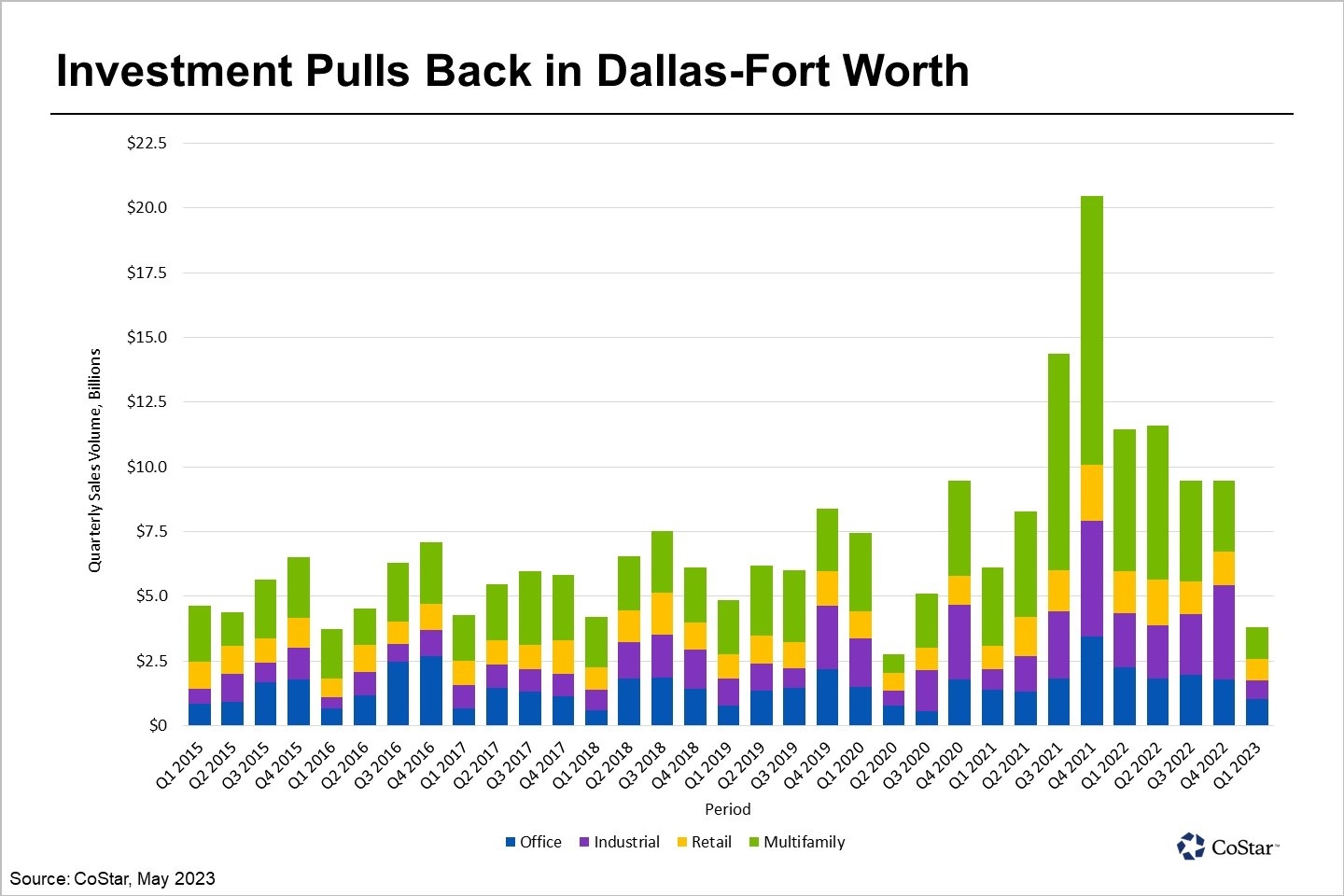

For the past few years, Texas multifamily was one of the hottest real estate investments in the country.

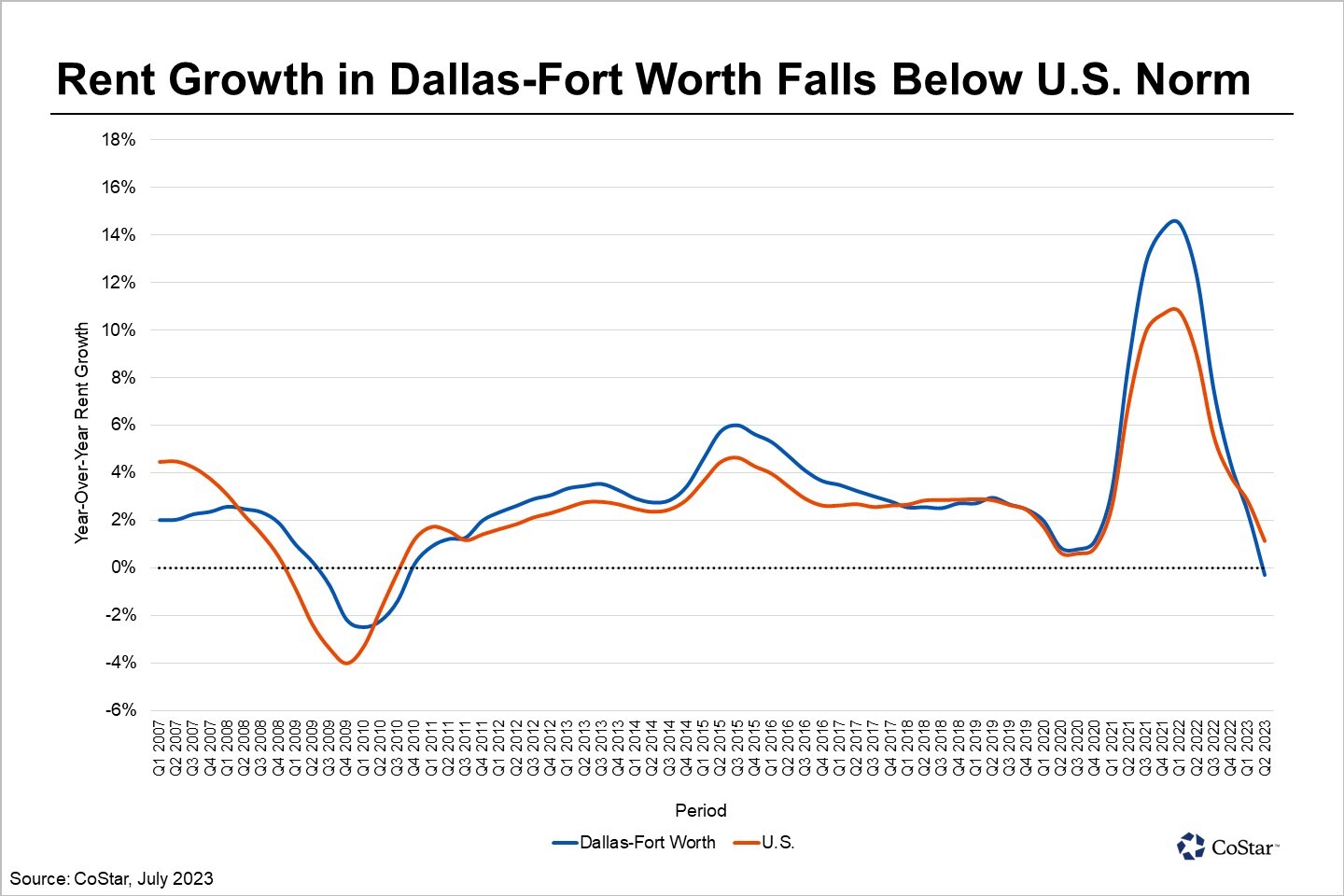

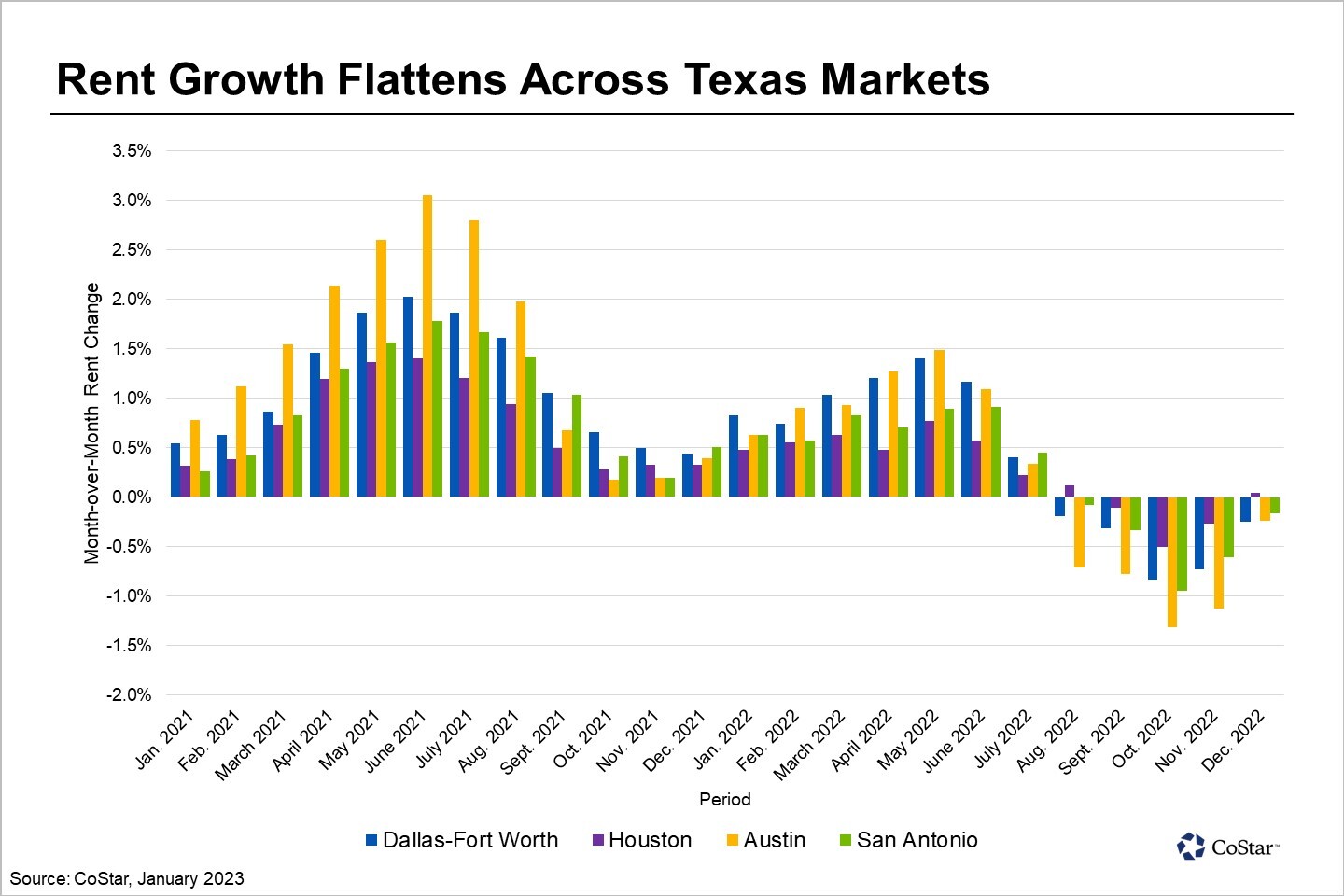

Annual rent growth in Dallas-Fort Worth trended negative in the second quarter for the first time since the third quarter of 2010.

The U.S. multifamily market has its own spike of debt maturities looming in the fall, but without the existential doubt of the office sector, borrowers are in a totally different position.

While rent growth continues to cool rapidly, apartment demand is rebounding so far in 2023.

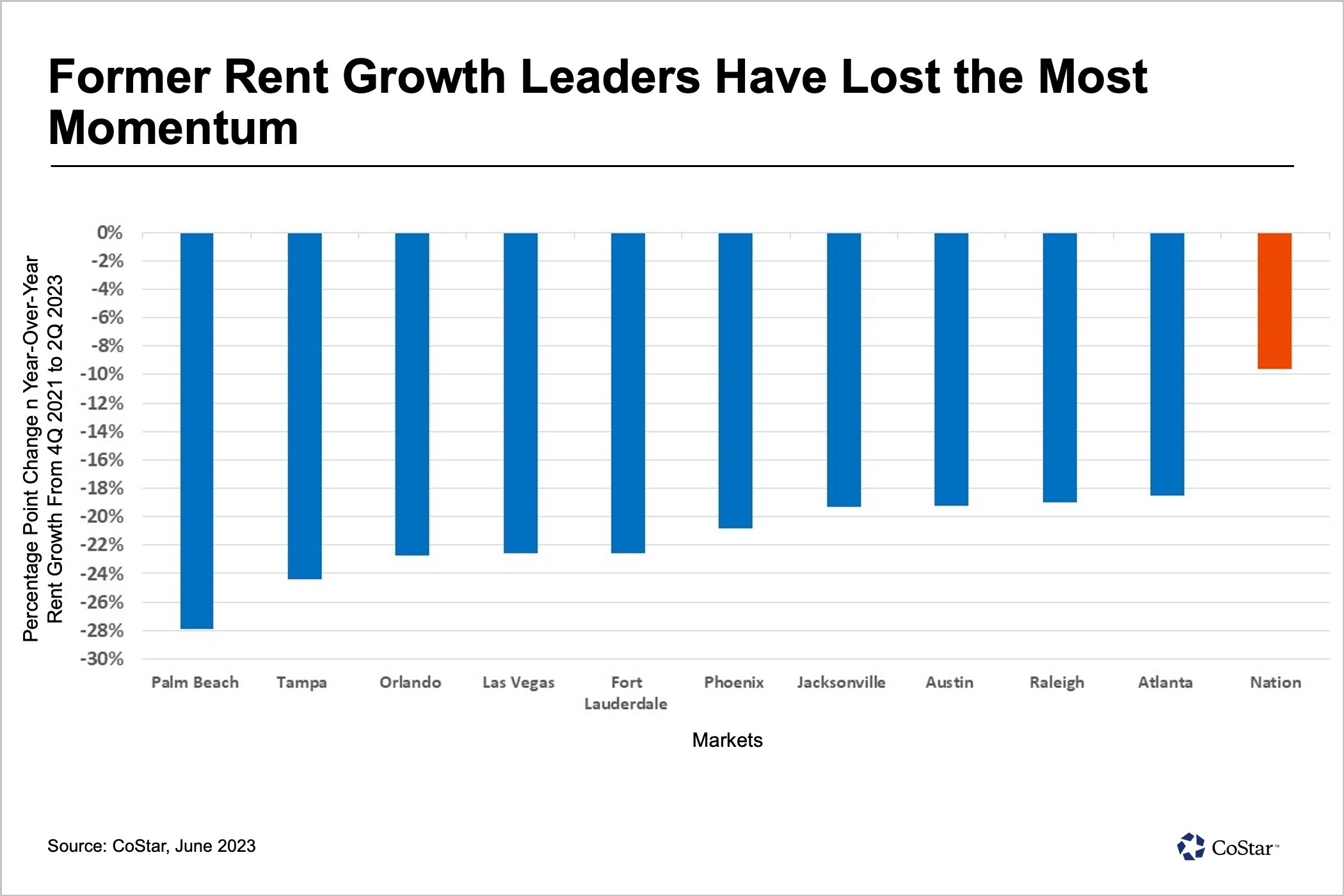

Multifamily rent growth in the United States is experiencing its largest retreat on record, with rents growing just 1.1% since the end of 2021 after hitting an all-time high of 10.7%.

Skyrocketing property values are the latest headache for multifamily owners in North Texas who have spent the last few months fending off hits to their bottom line.

The commercial real estate market is increasingly divided with larger properties seeing prices fall, while smaller properties gain in value, according to CoStar Group’s latest repeat-sales indices report.

Either garden-style apartments have more room to run or the price movement in high rises has been too fast.

As historic levels of apartment units deliver across the country, nationwide vacancy has reached its highest point since 2021, with the market dynamics shifting in favor of tenants.

Property sales in Dallas-Fort Worth have stalled over the past several quarters in light of rising interest rates and elevated economic uncertainty.

For the first time since the Fed began raising interest rates in early 2022, underwriting assumptions for prime multifamily assets are beginning to stabilize.

It is a tale of two economies when it comes to the multifamily space in commercial real estate.

Property prices are plunging at the fastest rate since the Great Recession as higher interest rates slow demand across the United States.

Commercial real estate is increasingly coming into focus as a source of stress on the financial system, as hundreds of billions in loans in the sector are set to expire this year.

U.S. apartment sales may end this year's �first quarter at the lowest level in more than a decade as higher interest rates slowed demand.

Before the Fed began its regime to rase interest rates, many apartment investors took advantage of floating-rate loans offered by many private equity debt funds to snatch up assets, often at very aggressive loan-to-value ratios.

Appraisal business is down, as investment sales activity and refinancing deals have declined. Now, appraisers must rely on supplemental data to make value assessments.

Plenty of investment dollars ready to deploy in a sector that has returned to seasonality.

Multifamily rent growth across Texas markets fell from record performances over the past year.

When moving rents up to prevailing markets were a constant positive, things were easier. Now, many eyebrows are rising.

Retail construction continues to plummet in Dallas-Fort Worth as rising costs hamstring delivery of new space.

For the first time in nearly two years, rent growth in Dallas-Fort Worth has slowed to the single digits.

The Federal Reserve's move to quickly hike interest rates this year has injected a heavy dose of uncertainty into one of the most reliable commercial real estate investments over the past decade: multifamily.

Colliers' Jorg Mast says when inflationary pressures subside and interest rates settle down, DFW will continue to claim its place as one of the busiest multifamily markets in the country.

Area rents will rise by almost 12% in the coming 12 months, according to new forecast.

Plano has the highest area apartment rents, and head to Fort Worth for the best deals.

The COVID-19 crisis has certainly had a heavy impact on many sectors of the economy; however, the multifamily sector still has had a triumphant year.

Another big decline in office space occupancy in the fourth quarter caused Dallas-Fort Worth net leasing to decline almost 4 million square feet for all of 2020.

Nationwide, 63% of apartment renters report getting concessions. The most popular giveaways include free months or weeks of rent, waived or reduced deposits, gift cards and free parking.